![]() No matter what business you’re in, you need stuff. Even if you’re a service provider and not a retailer, you still need supplies and other things to keep your business going. So you’re going to need to track down what you’ve ordered, any bills you’ve received, and any payments you’ve made. (OK, I admit it. The “tracking down” thing makes it sound harder than it is, but I was really just looking for an excuse to use the dog photo. This isn’t hard. Promise.)

No matter what business you’re in, you need stuff. Even if you’re a service provider and not a retailer, you still need supplies and other things to keep your business going. So you’re going to need to track down what you’ve ordered, any bills you’ve received, and any payments you’ve made. (OK, I admit it. The “tracking down” thing makes it sound harder than it is, but I was really just looking for an excuse to use the dog photo. This isn’t hard. Promise.)

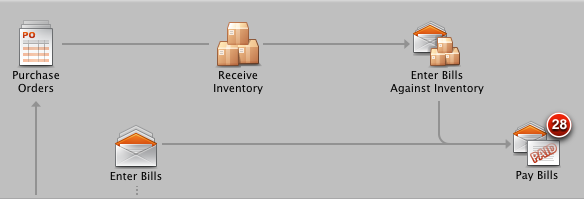

If you get lost along the way, just remember you can always go to the Home Page in QuickBooks and follow the arrows.

Order items with POs

Ordering goods or services to be paid for at a later time is a purchase order (PO). QuickBooks uses POs to track outstanding orders for you. Then, when you receive the items or the services are complete, you can mark them as received on the purchase order.

Ordering goods or services to be paid for at a later time is a purchase order (PO). QuickBooks uses POs to track outstanding orders for you. Then, when you receive the items or the services are complete, you can mark them as received on the purchase order.

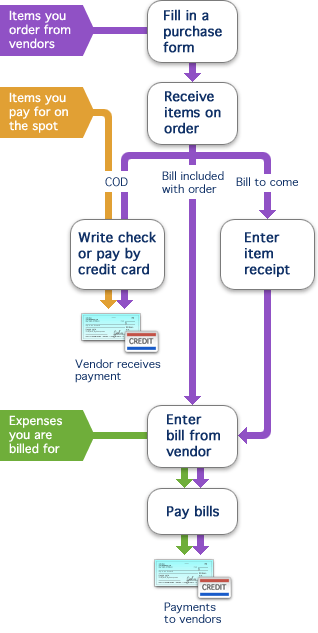

Of course you don’t have to use a PO to order the items you need. You can just pay for them on the spot as described in the next section.

Receiving items

When you receive items, what you do depends on your situation.

If you’re buying items on the spot (probably not using a PO), you can just pay by cash, check, or credit card. Just be sure the transaction is entered in QuickBooks. If you pay with cash, you can record this with a check in QuickBooks using your Petty Cash account and entering “Cash” or something that’s meaningful to you in the Check No field. And that’s it. You’re done.

If you receive a shipment with a packing slip but no bill, record the arrival of the shipment by entering an item receipt. Later, when you you get the bill, you can just check “Bill Received” on the item receipt to convert it to a bill.

If you receive a bill with the shipment, use Enter Bill to record it. When you enter a bill, QuickBooks automatically posts the amount to the correct expense account and updates your company’s balance with the vendor who sent the bill.

Video: See how Hannah uses all three of these methods.

Pay the bill

When it’s time to pay your bills, you can list all the bills your company owes and record the payments in QuickBooks with Pay Bills. You then mark which bills you want to pay, and indicate how you want to pay (by check or credit card). QuickBooks records the payments and updates your vendor balances.

Tracking related expenses

You may be asking yourself about tracking expenses, especially since we’ve got that pretty green box in our handy graphic that says “Expenses you are billed for.” There’s an Expenses pane at the bottom of the Enter Bills window. You may already be familiar with it as a way to track your business expenses like a bill from the utility company. But you can also use it to enter expenses related to items you’ve ordered like postage and shipping.

So that’s an overview of how to track things your order in QuickBooks. If you want to know more about transactions types you use with vendors, I suggest reading So many choices, Part 2: Vendor transactions and more. Happy ordering!